Enjoy the speed of Applying for Fast Cash Whenever You Need It

Wiki Article

All Concerning Cash Loan: Discovering Qualification Requirements and Benefits of Payday Advance

Cash advances and payday loans function as prompt economic options for those in need. They provide fast accessibility to funds with very little demands. Possible debtors need to navigate specific qualification requirements. Understanding these factors is essential for making educated choices. Furthermore, the dangers and benefits related to these financial products necessitate mindful factor to consider. What should one bear in mind before choosing such fundings?Understanding Cash Loan: Definition and Function

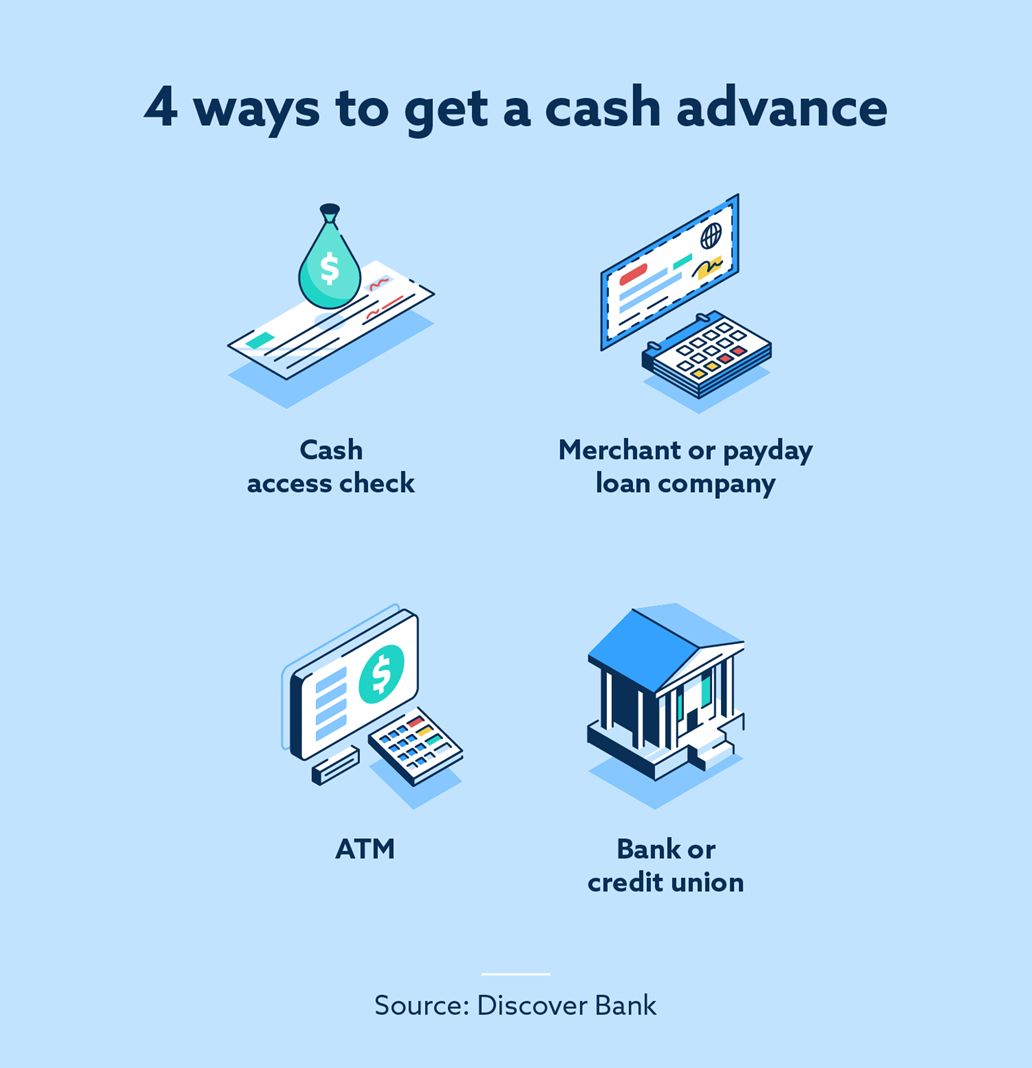

A cash loan acts as a short-term economic service for people facing instant money circulation difficulties. It allows debtors to access a portion of their future earnings or credit limitation prior to the scheduled payday or payment cycle. Usually supplied by credit history card providers or through payday advance loan services, cash loan provide quick accessibility to funds without the extensive authorization processes connected with standard loans.The main function of a cash money advance is to bridge monetary spaces, allowing people to cover unanticipated expenditures such as medical bills, vehicle repair services, or immediate house needs. Though practical, money developments usually feature higher rates of interest and charges compared to conventional financings, making them a pricey alternative otherwise settled without delay. Recognizing the nature and ramifications of cash breakthroughs is crucial for individuals to make enlightened monetary choices and prevent potential mistakes associated with borrowing.

Usual Qualification Criteria for Money Advances

Eligibility for cash loan normally rests on numerous key variables that loan providers take into consideration before accepting a request. To start with, applicants have to be at the very least 18 years old and supply evidence of identity. A constant income source is also necessary, as it demonstrates the capability to repay the finance. Lenders frequently call for a bank account, which promotes the deposit of funds and payment. In addition, a minimum earnings limit is typically established, guaranteeing that consumers can manage the settlement terms. Some lenders might likewise check credit rating, although many cash development alternatives are available to those with less-than-perfect credit scores. Residency condition may play a function, as some loan providers only serve particular geographical areas. Comprehending these requirements can assist possible debtors determine their qualification before making an application for a cash loan.

The Application Process: What to Anticipate

When customers determine to make an application for a cash development, they can expect a straightforward procedure that usually includes several essential actions. They should finish an application, which is generally available online or at a physical location. This type needs individual details, consisting of identification, income details, and banking info.

After approving the deal, funds are typically paid out quickly, in some cases within the very same day. Borrowers must be prepared to assess the car loan arrangement thoroughly before signing, guaranteeing they understand all conditions. Overall, the application procedure for a cash loan is created to be efficient, enabling borrowers to gain access to funds in a prompt manner when needed.

Benefits of Money Breakthroughs and Cash Advance Loans

Although cash advancements and payday advance are frequently seen with caution, they use numerous benefits for debtors encountering prompt economic demands. One substantial advantage is the fast accessibility to funds. Debtors can normally get money within a short time frame, often as quickly as the hop over to here following service day, enabling them to deal with urgent expenses such as clinical costs or car fixings.Furthermore, these finances normally require marginal paperwork, making the application process obtainable and simple, especially for those without a solid debt background. Cash breakthroughs and cash advance additionally supply flexibility pertaining to funding amounts, permitting customers to demand only what they require.

They can aid individuals connect the void in between paychecks, guaranteeing that essential costs are paid on time and stopping late costs. In general, for those in a limited financial area, these loans can act as a beneficial short-term option.

Responsible Borrowing: Tips for Handling Short-Term Loans

When utilizing short-term fundings like cash money breakthroughs and cash advance lendings, numerous debtors locate it crucial to adopt responsible borrowing methods. Understanding the terms and conditions of the loan is basic; debtors should read the fine print to avoid hidden fees. Creating a budget can help guarantee that repayment is manageable, allowing borrowers to allocate funds efficiently without compromising their economic security. It is likewise suggested to borrow only what is required, as taking out bigger loans can cause more significant settlement obstacles. Timely settlements are important to preserving a positive credit report and staying clear of extra fees. Looking for options, such as debt therapy or other finance options, can supply more sustainable financial options. By applying these techniques, borrowers can navigate short-term loans better, decreasing risks and advertising monetary health and wellness over time

Frequently Asked Inquiries

Can I Get a Money Advancement With Bad Credit Scores?

Yes, people with negative credit useful link rating can get a money breakthrough. Several loan providers consider alternate variables past credit rating, such as income and employment background, offering options for those facing monetary problems in spite of inadequate debt rankings.How Rapidly Can I Obtain Funds After Approval?

When approved, individuals can usually get funds within hours or by the following business day, relying on the loan provider's policies and the approach of disbursement picked, such as straight down payment or examine issuance.Are There Any Charges Connected With Cash Loan?

Cash developments typically incur numerous charges, including transaction costs, interest fees, and potential service charge (Installment Loans). These expenses can considerably raise the total quantity repayable, making it necessary for individuals to evaluate terms before proceedingCan I Repay a Cash Loan Early?

Yes, one can usually settle a cash loan early. This technique may aid minimize rate of interest prices, however it's advisable to check specific terms with the lender to verify any relevant costs or conditions.What Occurs if I Can't Repay My Cash Loan on schedule?

If an individual can not settle a cash loan on time, they might sustain late costs, increased rates of interest, or possible collection initiatives. This could adversely impact their credit rating rating and monetary stability substantially.Cash money developments and payday finances offer as immediate financial services for those in demand. A cash money advancement offers as a short-term monetary service for people facing immediate money flow obstacles. Convenient, cash money advances usually come with higher passion rates and costs contrasted to standard car loans, making them a pricey alternative if not paid off without delay. Cash advances and cash advance lendings are frequently seen with care, they use numerous advantages for debtors encountering prompt monetary over here demands. Numerous consumers locate it important to adopt liable borrowing practices when using short-term car loans like money developments and cash advance financings.

Report this wiki page